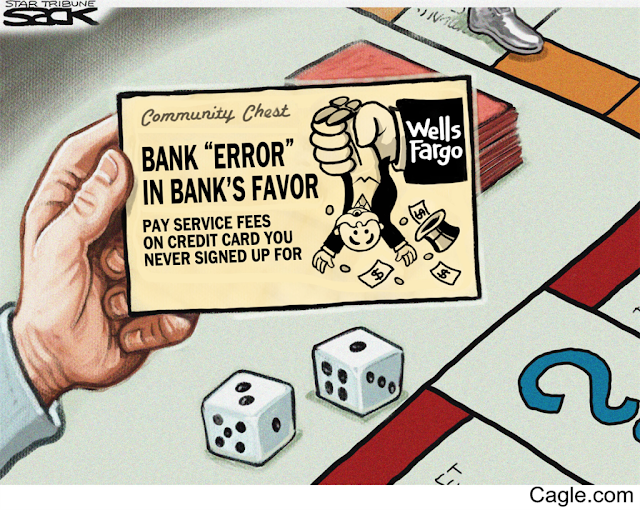

Reverse Mortgage Solutions Scam Alert!

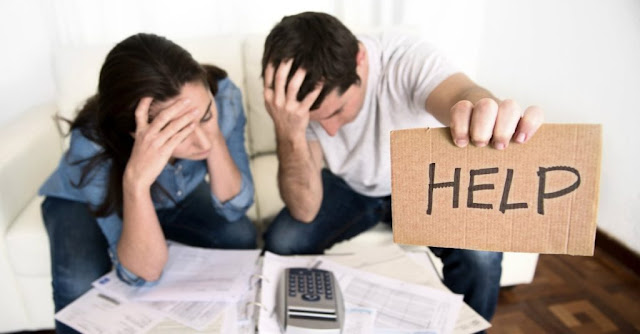

REVERSE MORTGAGE SOLUTIONS SCAM ALERT! Reverse Mortgage Solutions Targets Seniors For Foreclosure! MFI-Miami has issued a Reverse Mortgage Solutions Scam Alert! It seems like Reverse Mortgage Solutions is pulling a reverse mortgage scam on unsuspecting seniors with Reverse Mortgage. They are showing no shame in doing it either. Reverse mortgages are great because they give seniors who are house rich and cash poor needed cash. Local taxes and any HOA fees are still the responsibility of the homeowner. Servicers can and will foreclosure if the taxes are not paid. Reverse mortgages are great for most seniors. Unfortunately, reverse mortgage servicing companies like RMS have figured out how to cash in by screwing equity-rich seniors with Reverse Mortgages. Read more at MFI-Miami